Income-generating assets are investments that provide regular passive income while potentially appreciating in value over time. These assets form the foundation of financial stability and long-term wealth creation, making them essential tools for sustainable passive income generation in India. The right combination of income-generating assets can create multiple revenue streams, helping investors achieve their financial goals while maintaining a steady cash flow.

Best Income Generating Assets in India

Fixed Income Assets

Fixed Deposits (FDs)

Fixed Deposits represent one of the most secure income-generating assets in India, offering guaranteed returns ranging from 5.5% to 7.5% annually. Banks and financial institutions provide flexible interest payout options including monthly, quarterly, or annual disbursements. With minimum investments starting from just ₹1,000 and tenure options ranging from 7 days to 10 years, FDs cater to diverse investor needs. Senior citizens often enjoy preferential rates, making FDs particularly attractive for retirees seeking regular income.

Government Bonds

Government bonds provide investors with sovereign-guaranteed returns, typically offering interest rates between 7-8%. These bonds distribute interest payments semi-annually, providing a reliable income stream. The RBI Retail Direct platform has made government bond investments more accessible to retail investors. Various government bonds also offer tax benefits, enhancing their effective returns. The sovereign guarantee makes these bonds among the safest income-generating instruments in India.

Market-linked Income Assets

Dividend-paying Stocks

Dividend-paying stocks from established companies offer a combination of regular income and potential capital appreciation. Blue-chip companies typically provide dividend yields ranging from 3-7%, with distributions made quarterly or annually. Beyond regular dividends, investors may benefit from special dividends, bonus shares, and rights issues. Companies with consistent dividend policies often demonstrate strong financial health and sustainable business models.

Mutual Funds with Regular Payout Options

Mutual funds offering regular payouts provide professionally managed investment options for income seekers. Monthly Income Plans (MIPs) and dividend options in both equity and debt funds cater to different risk appetites. Systematic Withdrawal Plans (SWPs) enable investors to receive regular income while maintaining investment flexibility. The professional management ensures optimal portfolio allocation across multiple securities, balancing income generation with growth potential.

Real Estate Income

Fractional Real Estate

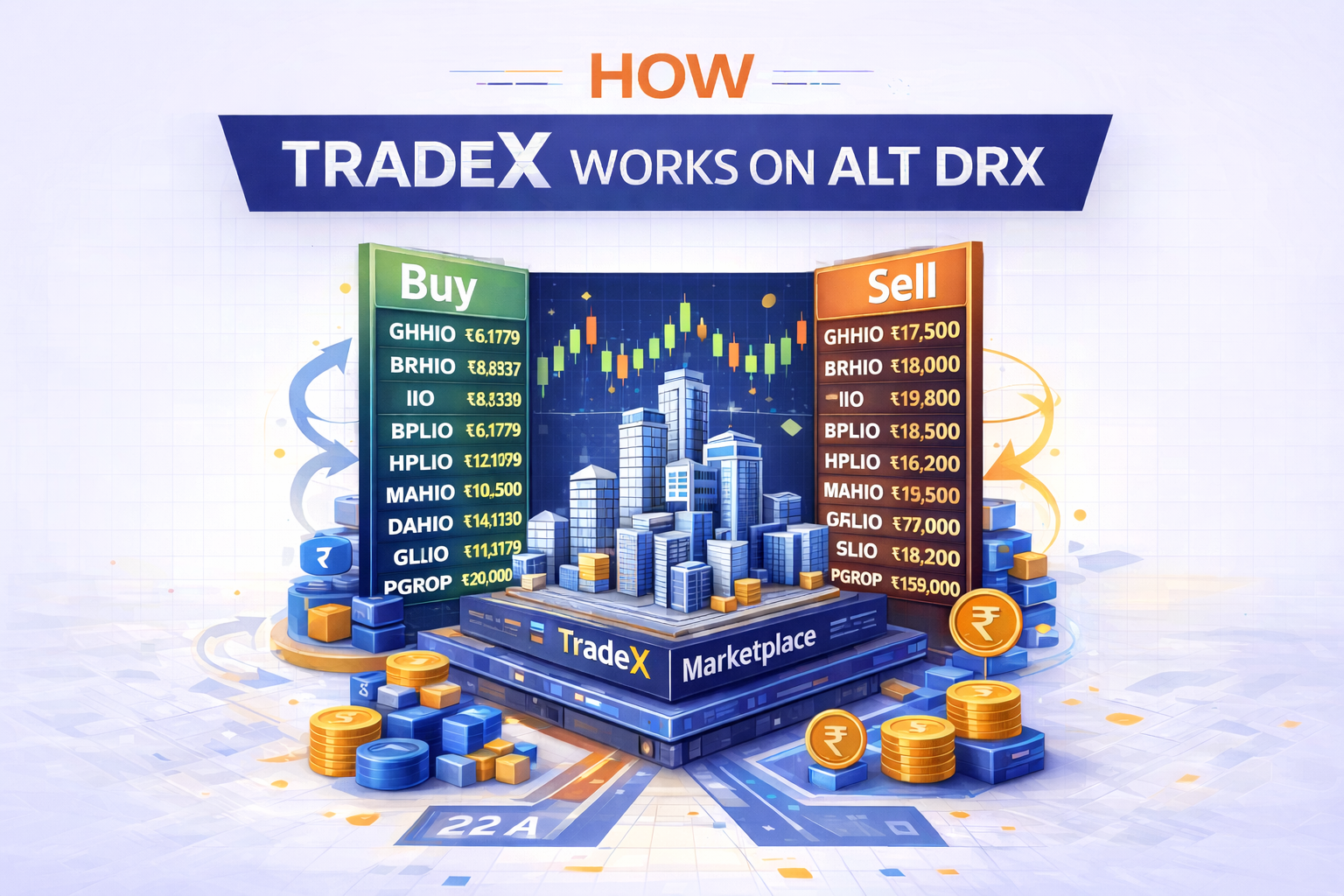

Alt DRX has revolutionized real estate investment in India by introducing an innovative fractional ownership model. This platform enables investors to participate in premium real estate opportunities starting from just ₹10,000, calculating ownership on a per-square-foot basis. Investors can access prime properties in thriving metropolitan areas including Mumbai, Bangalore, and Hyderabad. The platform handles all aspects of property management professionally, distributing rental income regularly while maintaining complete transparency through digital ownership tracking. This approach democratizes access to high-value real estate investments while offering both steady rental income and potential capital appreciation.

Rental Properties

Traditional rental properties remain a cornerstone of real estate income generation. Whether residential or commercial, rental properties provide monthly income while typically appreciating over time. Property owners benefit from various tax advantages related to maintenance and depreciation. Real estate investments also offer natural protection against inflation as both property values and rental rates tend to increase over time. Many investors leverage home loans to acquire rental properties, using tenant payments to cover mortgage costs while building equity.

Real Estate Investment Trusts (REITs)

REITs offer a modern approach to real estate investment through stock exchange-listed vehicles. These trusts typically invest in high-grade commercial properties, generating regular income through rental yields. Professional management teams handle property acquisition, maintenance, and tenant relationships. With minimum investments of ₹10,000-15,000, REITs provide access to institutional-grade real estate while offering stock market liquidity.

Alternative Income-generating Assets

Peer-to-Peer (P2P) Lending

P2P lending platforms enable direct lending through regulated marketplaces, offering returns between 12-18% annually. These platforms facilitate monthly interest payments while allowing investors to diversify across multiple borrowers. Each platform maintains its own minimum investment requirements and employs sophisticated credit assessment methods to manage risk. The digital nature of P2P lending makes it convenient for investors to monitor and manage their lending portfolio.

Digital Real Estate Platforms

Modern digital platforms have transformed property investment by enabling fractional ownership of premium properties. These platforms provide regular rental income streams while handling all aspects of property management professionally. The digital infrastructure ensures complete transparency in ownership tracking and income distribution. Investors can easily diversify across multiple properties while benefiting from potential value appreciation, all with lower initial investment requirements than traditional real estate.

Retirement-focused Income Assets

National Pension System (NPS)

The National Pension System combines retirement savings with income generation through its market-linked approach. The scheme offers multiple tax benefits and provides professional fund management services. Investors can choose their preferred asset allocation strategy, adapting it over time to match their risk profile. Post-retirement, NPS offers various annuity options to ensure regular income streams throughout retirement.

Senior Citizen Saving Scheme (SCSS)

The Senior Citizen Saving Scheme specifically addresses retirees’ income needs by offering attractive interest rates, currently at 8.2%. The scheme provides quarterly interest payouts, ensuring regular income for daily expenses. Government backing ensures complete safety of the invested amount. With tax benefits under Section 80C and a maximum investment limit of ₹15 lakhs, SCSS serves as a cornerstone of retirement income planning.

Conclusion

India’s landscape of income-generating assets offers diverse opportunities for passive income generation. The emergence of digital platforms, particularly Alt DRX’s innovative approach to fractional real estate ownership, has democratized access to premium income-generating assets. Successful income generation requires careful consideration of factors including investment amounts, expected returns, payout frequency, risk tolerance, investment horizon, tax implications, and management requirements. Modern innovations in fractional ownership have made it possible for investors to build diversified portfolios with lower capital requirements while enjoying professional management and regular income streams. This transformation of traditional asset classes through technology has opened new opportunities for investors to create sustainable passive income while managing risk effectively.