Digital real estate has evolved significantly beyond its original concept of domain names and websites. Today, it encompasses innovative platforms that enable digital ownership of physical properties, revolutionizing how people invest in real estate. This transformation has made premium real estate investment accessible to a broader range of investors through digital platforms and fractional ownership models.

Types of Digital Real Estate Investments

Digital Fractional Ownership Platforms

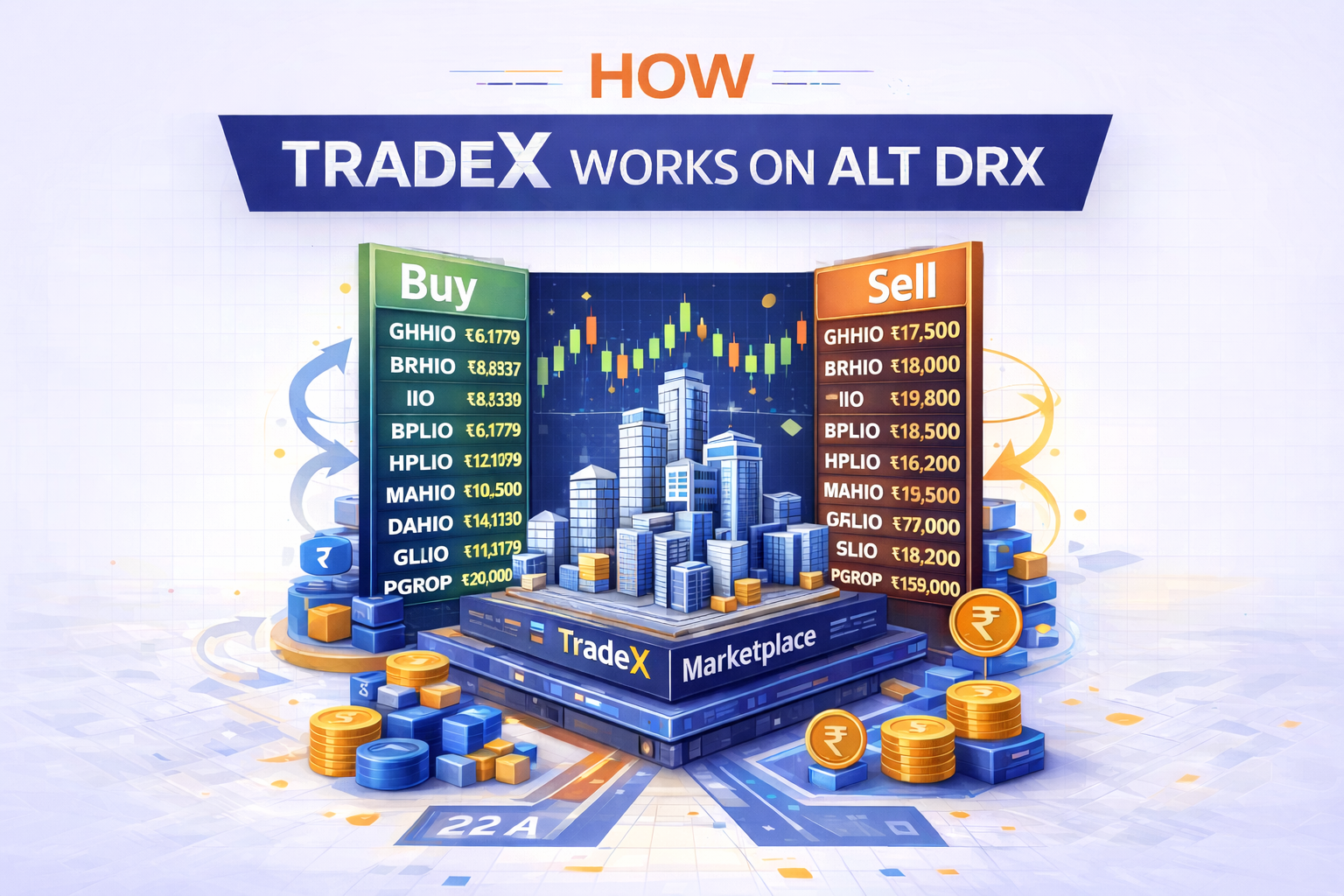

Leading the innovation in digital real estate, platforms like Alt DRX have transformed traditional property investment by enabling digital fractional ownership of premium physical properties. This modern approach allows investors to own shares in high-value properties across Mumbai, Bangalore, and Hyderabad, starting from just ₹10,000. The platform provides complete digital management of property ownership, rental income distribution, and investment tracking.

Real Estate Investment Platforms

Digital platforms facilitating direct property investments have emerged as significant players in the digital real estate space. These platforms connect property sellers with potential buyers, though they typically require larger capital commitments than fractional ownership models.

Real Estate Investment Trusts (REITs)

Digital trading of REITs represents another form of digital real estate investment. While REITs provide real estate exposure through stock market trading, they offer less direct ownership than fractional ownership platforms.

Metaverse Real Estate

Virtual property ownership in metaverse platforms represents an emerging sector of digital real estate. However, this speculative market differs significantly from platforms offering ownership in physical properties.

How to Get Started with Digital Real Estate Investment

Starting with digital real estate investment has become remarkably straightforward through modern platforms. For fractional ownership through Alt DRX, investors begin by registering on the platform and completing standard KYC requirements. The digital interface allows investors to browse available properties, review detailed information about locations and expected returns, and make investment decisions with complete transparency.

The platform handles all aspects of property management professionally, from tenant acquisition to maintenance and rental collection. This professional management ensures a truly passive investment experience while maintaining complete digital tracking of ownership and returns.

Acquiring Digital Real Estate

Property Selection Process

Digital platforms provide comprehensive property information, enabling informed investment decisions. Alt DRX carefully selects premium properties in high-growth metropolitan areas, conducting thorough due diligence before offering investment opportunities. Investors can review detailed property reports, location analysis, and expected return projections through the digital interface.

Investment Process

The digital investment process through platforms like Alt DRX involves selecting desired properties and determining investment amounts. The platform calculates ownership shares based on investment size, with each share representing specific square footage in the property. Digital documentation and payment processing ensure secure, efficient transactions.

Management and Returns

Professional teams handle all aspects of property management, while the digital platform provides real-time updates on property performance and rental income distribution. This combination of professional management and digital tracking creates a seamless investment experience.

Risks and Challenges of Digital Real Estate Investment

Platform Security

Digital platforms must maintain robust security measures to protect investor information and transactions. Reputable platforms like Alt DRX employ advanced security protocols and maintain regulatory compliance to ensure safe investment operations.

Market Risks

While digital platforms simplify investment processes, real estate market risks remain relevant. However, focusing on premium properties in major metropolitan areas helps mitigate market-specific risks.

Technology Dependence

Digital real estate investment relies on platform technology and infrastructure. Leading platforms maintain robust systems with redundancy and backup measures to ensure consistent operation.

Future Trends in Digital Real Estate

Increasing Digitalization

The trend toward digital real estate investment continues to accelerate, with platforms offering increasingly sophisticated features and investment options. Technology improvements enhance user experience and investment management capabilities.

Market Expansion

Digital platforms are expanding their property portfolios and geographical coverage, providing investors with broader investment opportunities. This expansion maintains focus on premium properties while offering increased diversification options.

Enhanced Features

Ongoing platform development introduces new features for investment analysis, portfolio management, and return tracking. These improvements further streamline the investment experience while providing deeper insights into property performance.

Conclusion

Digital real estate investment, particularly through fractional ownership platforms like Alt DRX, represents the future of property investment. This modern approach combines the benefits of real estate investment with digital convenience and accessibility. The professional management, transparent operations, and low entry barriers make it an attractive option for investors seeking exposure to premium real estate markets.

For those looking to invest in real estate online or explore real estate investment without buying entire properties, digital platforms offer an optimal solution. Alt DRX’s model particularly stands out by providing access to premium properties with minimal capital requirements while maintaining professional management standards. As digital real estate continues to evolve, these platforms will likely play an increasingly important role in democratizing access to real estate investment opportunities.

Also Read: