Making money with limited capital has become increasingly accessible through innovative investment platforms and opportunities. Modern technology has transformed traditional investment barriers, enabling investors to participate in premium assets with minimal initial capital. This democratization of investment opportunities opens new avenues for wealth creation, regardless of starting capital.

Setting Financial Goals and Budgeting for Small Investments

Success with small investments begins with clear financial goals and disciplined budgeting. Understanding personal risk tolerance, investment timeline, and desired returns helps in selecting appropriate investment vehicles. Even small, regular investments can grow significantly over time when allocated strategically across suitable opportunities.

Best Ways to Make Money with Low Investments

Fractional Real Estate Investing

Platforms like Alt DRX have revolutionized real estate investment by enabling participation in premium properties starting from just ₹10,000. This innovative approach offers several advantages for investors with limited capital:

Access to Premium Properties: Invest in high-value residential properties across Mumbai, Bangalore, and Hyderabad without requiring substantial capital.

Professional Management: Expert teams handle all property-related responsibilities, creating truly passive income opportunities.

Regular Income: Monthly rental income provides steady returns, supporting consistent wealth building.

Blockchain Security: Advanced technology ensures transparent ownership records and secure transactions.

Growth Potential: Investment in premium locations offers both regular income and appreciation opportunities.

Systematic Investment Plans (SIPs) in Mutual Funds

SIPs allow regular investments in mutual funds starting from small amounts. While offering market exposure and professional management, returns remain subject to market volatility and lack the tangible asset backing of real estate investments.

Investing in Recurring Deposits (RDs)

Bank recurring deposits provide guaranteed but modest returns, typically ranging from 5.5% to 7% annually. While offering capital safety, returns may not keep pace with inflation, potentially limiting long-term wealth creation.

Stock Market Investments

Direct equity investment can start with small amounts through discount brokers. However, success requires significant market knowledge and active management, making it challenging for beginners with limited capital.

Peer-to-Peer (P2P) Lending

P2P platforms enable lending with modest amounts, offering potentially higher returns. However, default risks and platform stability concerns require careful consideration.

Investing in Gold (Digital Gold or Gold ETFs)

Digital gold and ETFs provide exposure to precious metals with small investments. While offering inflation protection, gold typically serves better as a portfolio diversifier than a primary investment.

Starting a Small Business or Side Hustle

Small businesses can generate income with limited initial investment. However, success requires significant time commitment and entrepreneurial skills, unlike passive investment options.

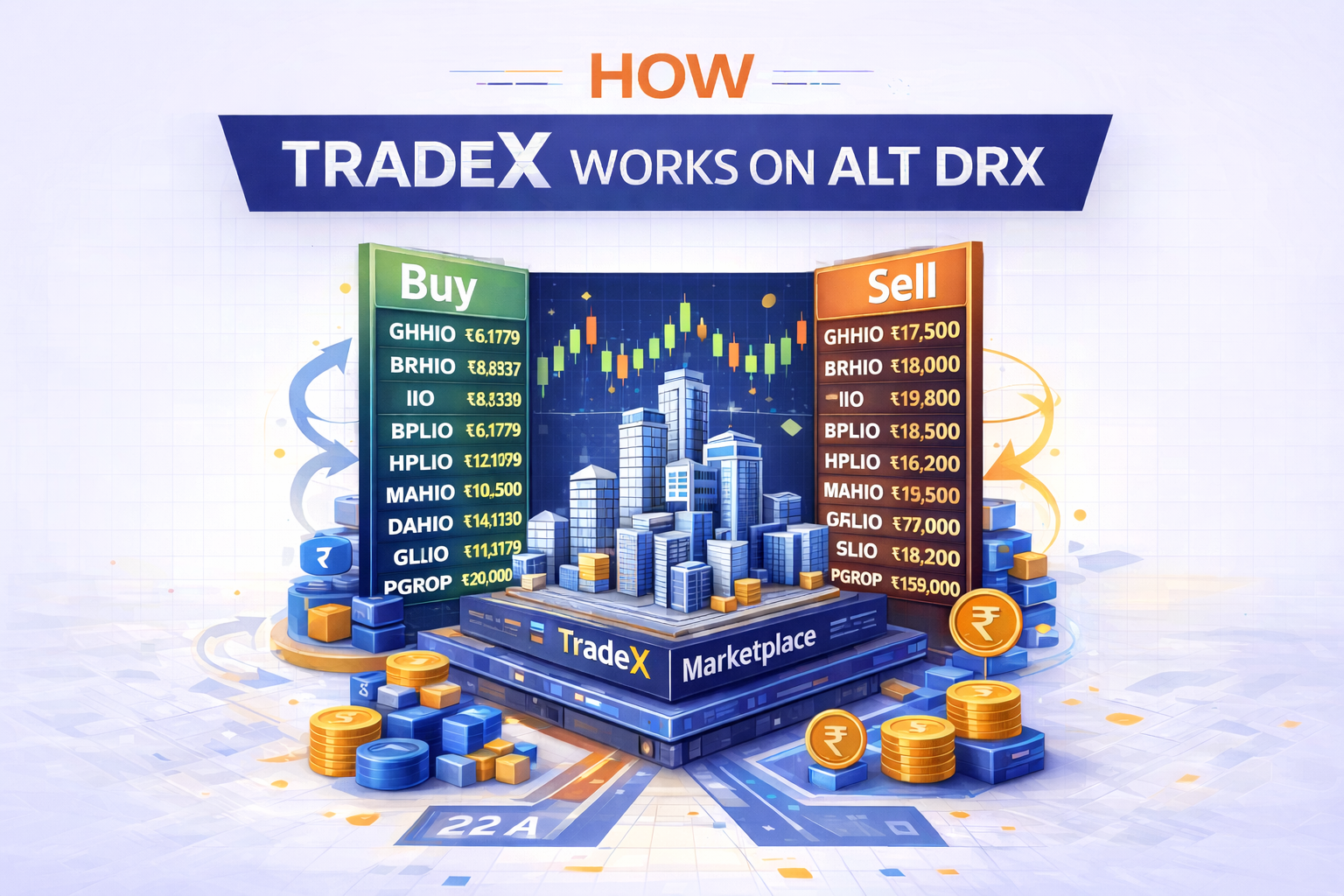

Start Fractional Real Estate Investing with Limited Capital

Alt DRX’s platform offers an ideal entry point for investors with limited capital. The process begins with simple registration and KYC verification, followed by access to premium property investment opportunities.

Platform Benefits: - Start investing with just ₹10,000 - Access premium residential properties - Receive professional property management - Enjoy regular rental income - Benefit from blockchain security - Track investments in real-time - Potential for capital appreciation

The Power of Compounding with Small Investments

Small, regular investments can grow significantly through compound returns. Different investment options offer varying compounding benefits:

Fractional Real Estate through Alt DRX: - Regular rental income reinvestment - Property value appreciation - Professional management benefits - Location-driven growth potential

Traditional Options: - Mutual Funds: Market-dependent returns - Fixed Deposits: Limited compound growth - Stock Market: Volatile returns requiring active management

Conclusion

Making money with low investment has become increasingly accessible through innovative platforms like Alt DRX. The fractional real estate model stands out by offering:

Accessibility: Start building wealth with just ₹10,000 in premium real estate markets.

Professional Management: Expert teams handle all property-related responsibilities.

Regular Income: Monthly rental distributions support steady wealth building.

Security: Blockchain technology ensures transparent and secure investments.

Growth Potential: Investment in premium properties offers both income and appreciation opportunities.

While various investment options exist for limited capital, fractional real estate through Alt DRX provides an optimal combination of accessibility, professional management, and growth potential. The platform’s innovative approach transforms premium real estate investment from a high-capital requirement to an accessible opportunity for investors starting with modest amounts.

Success in making money with low investment requires choosing the right platforms and maintaining investment discipline. Alt DRX’s platform offers a secure, transparent, and professional way to build wealth through real estate, making it an ideal choice for investors beginning with limited capital.