India’s real estate market presents compelling opportunities for Non-Resident Indians (NRIs) seeking to invest in their home country. Traditional real estate investment has evolved significantly with the emergence of digital platforms that simplify property ownership and management. These innovations have transformed how NRIs can participate in India’s growing real estate market, particularly in premium residential properties across major metropolitan areas.

Rules and Regulations for NRI Real Estate Investment

NRIs can invest in Indian real estate using various routes, with modern digital platforms offering simplified compliance. The Reserve Bank of India (RBI) permits NRIs to invest in real estate using: - NRE (Non-Resident External) Account - NRO (Non-Resident Ordinary) Account - Foreign remittances through normal banking channels

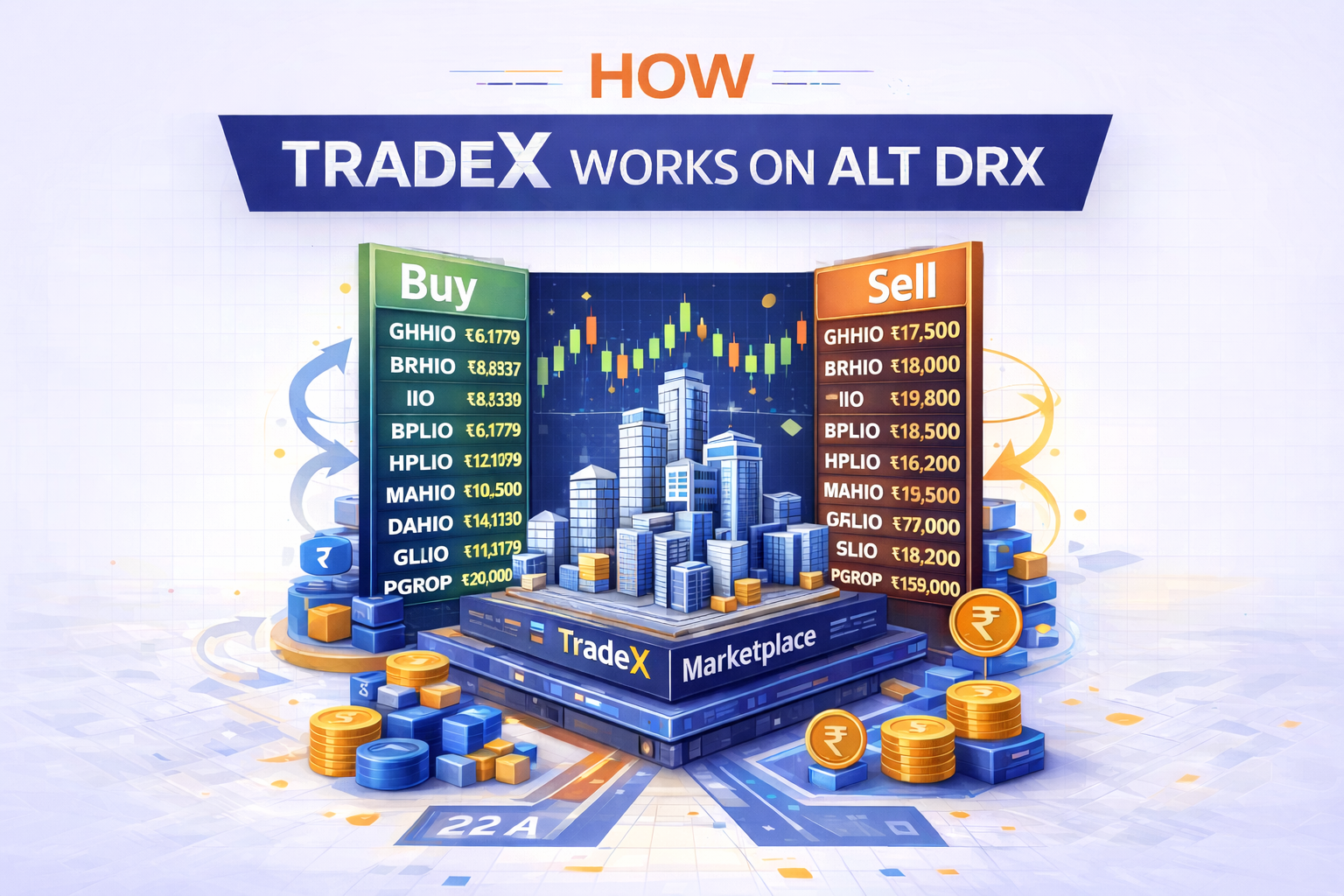

Platforms like Alt DRX have streamlined the investment process while ensuring full regulatory compliance. The platform’s digital infrastructure handles documentation requirements and maintains transparent records of all transactions, making it easier for NRIs to invest while adhering to all legal requirements.

Best Cities and Locations for NRI Real Estate Investment

Premium residential properties in major metropolitan areas offer NRIs the most attractive investment opportunities. Alt DRX focuses on high-potential locations across:

Mumbai: India’s financial capital, offering strong rental yields and appreciation potential in residential real estate.

Bangalore: The technology hub is driving significant demand for premium residential spaces.

Hyderabad is emerging as a major residential center with attractive growth prospects.

These cities provide robust infrastructure, strong tenant demand, and potential for both rental income and capital appreciation. The platform’s professional management ensures optimal property selection within these prime locations.

Tax Implications for NRIs Investing in Indian Real Estate

NRI real estate investment involves various tax considerations, which Alt DRX’s platform helps navigate effectively:

Income Tax: Rental income is taxable in India, with TDS applicable at specified rates.

Capital Gains: Short-term and long-term capital gains have different tax implications.

Tax Benefits: Various deductions are available under sections 24(b) and 80C of the Income Tax Act.

The platform’s blockchain infrastructure maintains detailed records of all transactions, simplifying tax compliance and documentation. Professional management handles tax-related paperwork and ensures proper reporting.

Key Considerations and Risks for NRIs in Real Estate Investment

Traditional real estate investment poses several challenges for NRIs: - Property management from overseas - Tenant selection and monitoring - Maintenance and repairs - Documentation and compliance - Regular income repatriation

Alt DRX’s platform addresses these challenges through:

Professional Management: Expert teams handle all property-related responsibilities.

Transparent Operations: Blockchain technology ensures clear ownership records and transaction history.

Automated Processes: Smart contracts manage rental income distribution and documentation.

Secure Transactions: Advanced technology protects investment and ensures compliance.

Regular Reporting: Digital dashboard provides real-time updates on property performance.

Benefits of NRI Real Estate Investment in India

Modern fractional ownership platforms offer numerous advantages for NRI investors:

Accessibility: Start investing with just ₹10,000, making premium property investment accessible.

Professional Management: Complete property management without requiring personal presence.

Regular Income: Monthly rental distributions directly to NRE/NRO accounts.

Blockchain Security: Immutable ownership records and transparent transactions.

Diversification: Ability to invest across multiple premium properties.

Growth Potential: Participation in India’s real estate growth through premium properties.

Easy Exit Options: More flexible exit possibilities compared to traditional real estate.

Conclusion

Digital platforms like Alt DRX have transformed NRI real estate investment in India, offering a sophisticated yet accessible investment solution. The platform combines the benefits of premium real estate investment with modern technology and professional management, making it ideal for NRI investors seeking exposure to Indian real estate markets.

Key advantages include:

- Simplified investment process

- Professional property management

- Regular income generation

- Complete transparency

- Regulatory compliance

For NRIs looking to invest in Indian real estate, Alt DRX’s platform provides an optimal combination of accessibility, security, and professional management. The focus on premium residential properties in major metropolitan areas, enhanced by expert management and innovative technology, creates an attractive investment opportunity that addresses traditional challenges faced by NRI investors.