In the dynamic landscape of India’s economy, identifying the best sectors for long-term investment is crucial for investors looking to build wealth and secure their financial future. This article explores the most promising sectors for long-term investment in India, including the emerging opportunity of fractional real estate investing.

Understanding Long-Term Investments

Long-term investments typically involve holding assets for five years or more. These investments are designed to:

- Capitalize on the power of compounding

- Ride out short-term market volatilities

- Align with long-term financial goals such as retirement planning or wealth creation

When considering the best sector to invest for future growth and the best sector to invest for good returns, it’s essential to look beyond short-term trends and focus on sectors with sustainable growth potential.

Criteria for Choosing Sectors for Long-Term Investment

Economic Growth and Development

Sectors that align with India’s overall economic growth trajectory are likely to perform well in the long run. Consider:

- GDP contribution and growth rate

- Employment generation potential

- Contribution to exports and foreign exchange earnings

Government Policies and Support

Sectors benefiting from favourable government policies and initiatives are often good choices for long-term investment. Look for:

- Tax incentives and subsidies

- Ease of doing business reforms

- Sector-specific development programs

Market Demand and Future Potential

Sectors with strong current demand and promising future prospects are ideal for long-term investments. Evaluate:

- Consumer trends and changing demographics

- Technological advancements and innovation potential

- Global market opportunities

Risk Factors and Stability

While all investments carry risks, some sectors are inherently more stable than others. Consider:

- Historical performance during economic downturns

- Regulatory environment and compliance requirements

- Competition and market saturation

Key Sectors for Long-Term Investment in India

1. Technology and IT Services

India’s technology sector continues to be a powerhouse, offering excellent long-term investment opportunities:

- Rapid digital transformation across industries

- Growing global demand for IT services and outsourcing

- Emerging technologies like AI, IoT, and cloud computing

Key players in this sector include Tata Consultancy Services, Infosys, and emerging startups in various tech domains.

2. Healthcare and Pharmaceuticals

The healthcare sector in India presents significant growth potential:

- Increasing healthcare expenditure and insurance penetration

- Growing demand for quality healthcare services

- India’s position as a global pharma manufacturing hub

Companies like Sun Pharma, Dr. Reddy’s Laboratories, and Apollo Hospitals are notable players in this sector.

3. Renewable Energy

With a strong focus on sustainability, the renewable energy sector is poised for long-term growth:

- Ambitious government targets for clean energy adoption

- Declining costs of renewable technologies

- Growing global emphasis on combating climate change

Investors can look at companies like Adani Green Energy, Tata Power, and various green energy funds.

4. Financial Services

The financial services sector is crucial for India’s economic growth and offers diverse investment opportunities:

- Increasing financial inclusion and digital banking adoption

- Growth in insurance and asset management sectors

- Emerging fintech solutions

HDFC Bank, ICICI Bank, and Bajaj Finance are some of the prominent players in this sector.

5. Consumer Goods and Retail

India’s growing middle class and increasing disposable incomes make this sector attractive for long-term investment:

- Changing consumer preferences and lifestyle upgrades

- E-commerce boom and omnichannel retail growth

- Rural market penetration

Companies like Hindustan Unilever, Asian Paints, and D-Mart are well-positioned in this sector.

6. Infrastructure and Real Estate

The infrastructure and real estate sector are crucial for India’s economic development and offers unique investment opportunities:

- Government focus on infrastructure development

- Urbanization and smart city initiatives

- Growing demand for affordable housing

Traditional real estate giants like DLF and Godrej Properties are key players, but an emerging trend in this sector deserves special attention: fractional real estate investing.

Why Fractional Real Estate Investment is a Good Long-Term Investment

Fractional real estate investing has emerged as an innovative way to participate in the real estate market, offering several advantages for long-term investors:

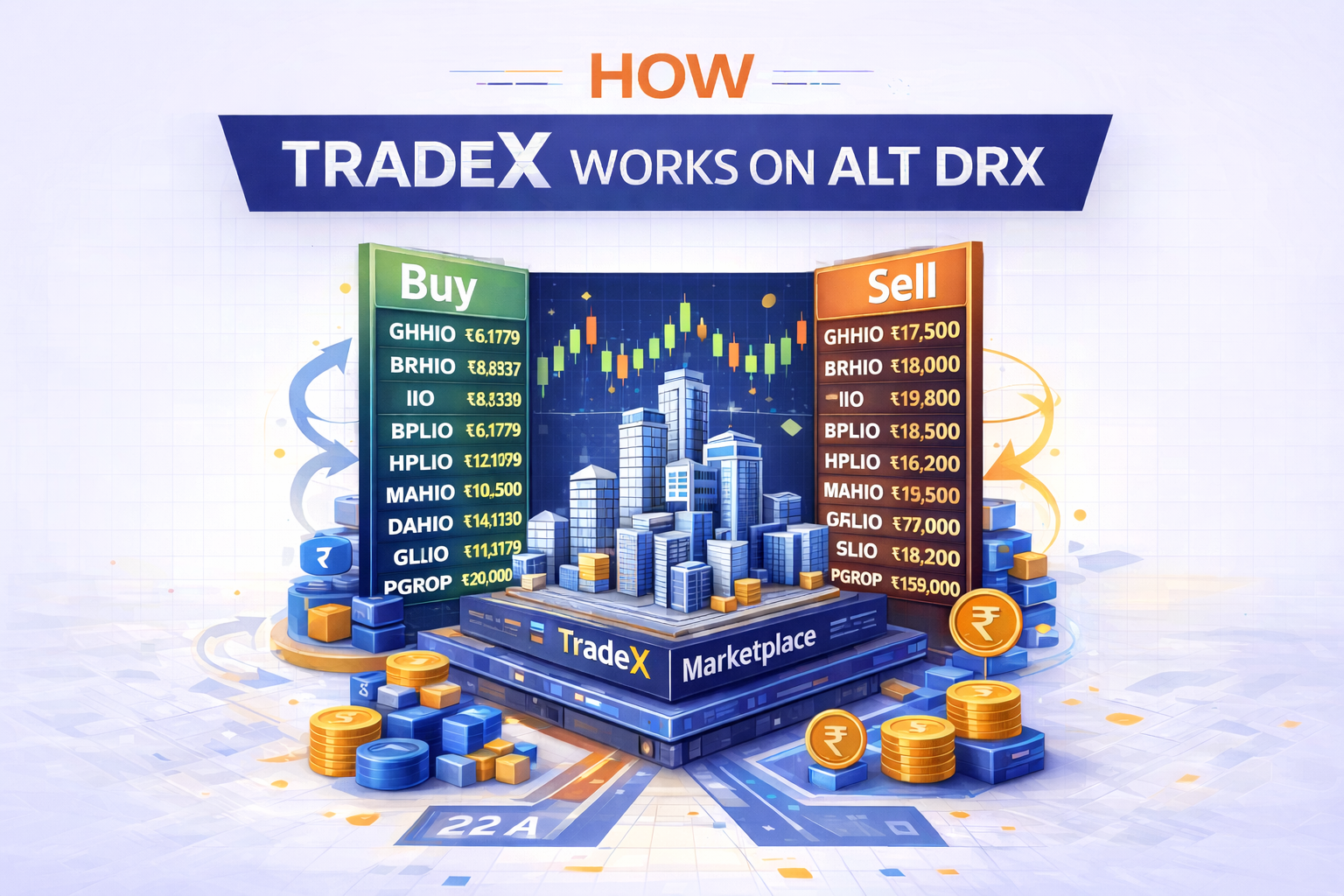

Accessibility: Platforms like alt DRX allow investors to enter the real estate market with relatively small amounts, making premium properties accessible to a wider range of investors.

Diversification: Investors can spread their capital across multiple properties and locations, reducing risk and potentially enhancing returns.

Professional Management: Fractional ownership often comes with professional property management, eliminating the hassles of being a landlord.

Regular Income: Many fractional real estate investments offer regular rental income, providing a steady cash flow.

Capital Appreciation: Investors benefit from the potential appreciation of property values over time.

Flexibility: With options like Monthly Investment Plans (MIPs), investors can systematically build their real estate portfolio over time.

Transparency: Digital platforms provide detailed information and regular updates on property performance and financials.

Alt DRX, for example, offers goal-based investment plans that allow investors to work towards specific financial targets through systematic investments in premium real estate properties.

Conclusion

When considering the best sectors to invest in India for the long term, it’s crucial to look at both traditional sectors and emerging investment models. Technology, healthcare, renewable energy, financial services, consumer goods, and infrastructure/real estate all offer promising long-term growth potential.

The rise of fractional real estate investing, exemplified by platforms like alt DRX, adds an exciting dimension to long-term investment strategies. It allows investors to participate in the real estate market with lower entry barriers while benefiting from professional management and potential for both regular income and capital appreciation.

As with any investment decision, it’s essential to:

- Conduct thorough research on specific sectors and companies

- Diversify your portfolio across multiple sectors to manage risk

- Align your investments with your long-term financial goals

- Consider seeking advice from financial professionals

By carefully selecting sectors with strong growth potential and leveraging innovative investment models like fractional real estate, investors can position themselves for long-term success in India’s dynamic and growing economy.

Remember, the best sector to invest for the future is one that aligns with both broader economic trends and your personal financial objectives. Whether you choose to invest in traditional sectors, explore fractional real estate, or create a diversified portfolio across multiple areas, a long-term perspective and disciplined approach will be key to achieving your investment goals.

Also Read: